Source: Sifted.eu

Banks, banks, and even more banks

With their savvy interfaces, smart features and oodles of VC money, digital banks have become the poster-child for fintech. There are now almost 300 so-called “neobanks” live worldwide, with nearly half concentrated in Europe.

Meanwhile, new players are continuing to join the ranks, particularly in Latin America, Africa and the Middle East. This boom is being fuelled by ongoing investor enthusiasm for the sector, with neobanks raising over $2bn in venture capital globally this year alone. Customers are also riding the neobank wave. PitchBook estimates that by 2024, 145m of us will be using these apps across North America and Europe alone.

To help keep track of the global neobank landscape, we have broken down the key data and trends. For clarity, ‘neobank’ is defined here as an app that i) offers its own retail banking services (i.e. prepaid, debit, credit cards), ii) launched after 2010, and iii) is mobile-centric.* This definition does not distinguish between regulatory status, but it’s worth noting that only a handful have official bank licences. Here is the story of the world’s neobanks, as told in numbers.

The neobank boom: At its peak?

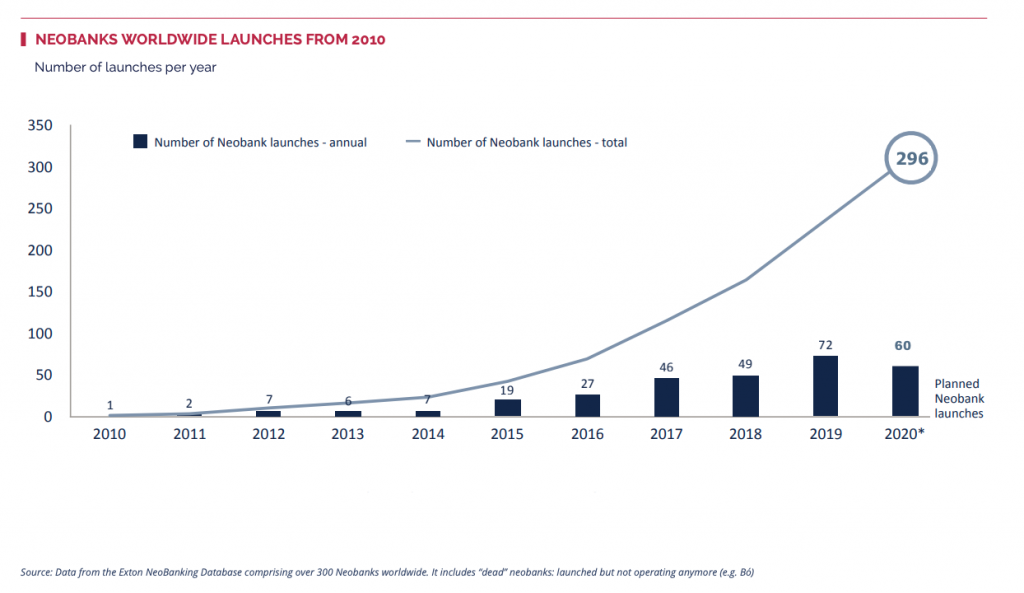

The number of neobanks worldwide has tripled since 2017, climbing from 100 to nearly 300 worldwide. That means, over the last three years, a neobank launched every five days somewhere in the world (!), according to Exton, a consultancy firm which manages a global database of consumer banking apps.

In 2019 alone, more than 70 neobanks went live globally.

But Cristoph Stegmeier, a partner at Exton, says we may finally have reached a peak, with 2020 seeing a slowdown.

“I expect we will see less from now,” he told Sifted.

He explained this year’s launch decline went beyond simply the ‘Covid effect’ and stems from the growing saturation of neobanks. Indeed, 30 neobanks have been wound down since 2015, according to Stegmeier. Still, the neobank boom hasn’t totally stalled. Over 30 neobanks launched in the face of the pandemic, including Zelf, Daylight (a US bank for LGBT+ members) and Tenpo in Chile. Meanwhile, dozens of new players are still planning to go live in 2021 — including Greece’s Woli and France’s Vybe.

Deixe um comentário

Você precisa fazer o login para publicar um comentário.